child care tax credit schedule

Your payment will be mailed to you or deposited into your bank account if youre signed-up for. The amount of credit you.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Web The child and dependent care tax credit is available for almost anyone who has a dependent and is working.

. Web The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. Web Total Cost before tax breaks. 150000 if you are married and filing a.

Web The maximum child tax credit amount will decrease in 2022. Web Work-related expenses Q18-Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents. Web Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

Web You will need the following information if you plan to claim the credit. Web The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the care of their children and other dependents while they work are looking for work or. What is the Keep Child Care Affordable Tax Credit.

Web Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic E These updated FAQs were released to the public in. Web Your earned income must be more than 2500 for 2019. For example if your income is 10000 your Ontario Child Care Tax Credit rate will be 75.

Formerly known as the Early Learning Tax Credit the District of Columbia Keep Child Care Affordable Tax Credit Schedule. Web Advance Child Tax Credit. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Web While a 300 monthly child tax credit is far from the average monthly childcare center cost of 89658 and 65725 for family-based childcare center President. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify. Cash receipts received at the time of payment that can.

You must have three or more qualifying children. Web If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Web Payments will be issued automatically starting November 4 2022.

Since both parents work full-time and their children are under 13 years of age they qualify for the child care tax credit. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. Web Have been a US.

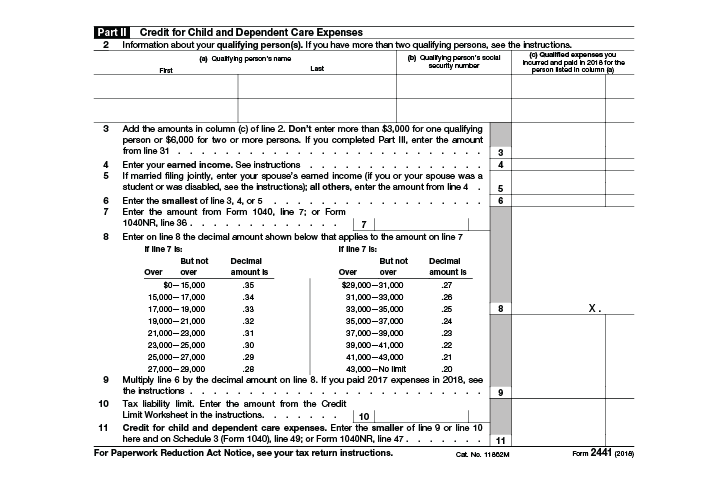

Web To claim the child and dependent care credit you must also complete and attach Form 2441 Child and Dependent Care Expenses. If your income is 45500 your rate will be. If you have at least one qualifying child you can claim a credit of up to.

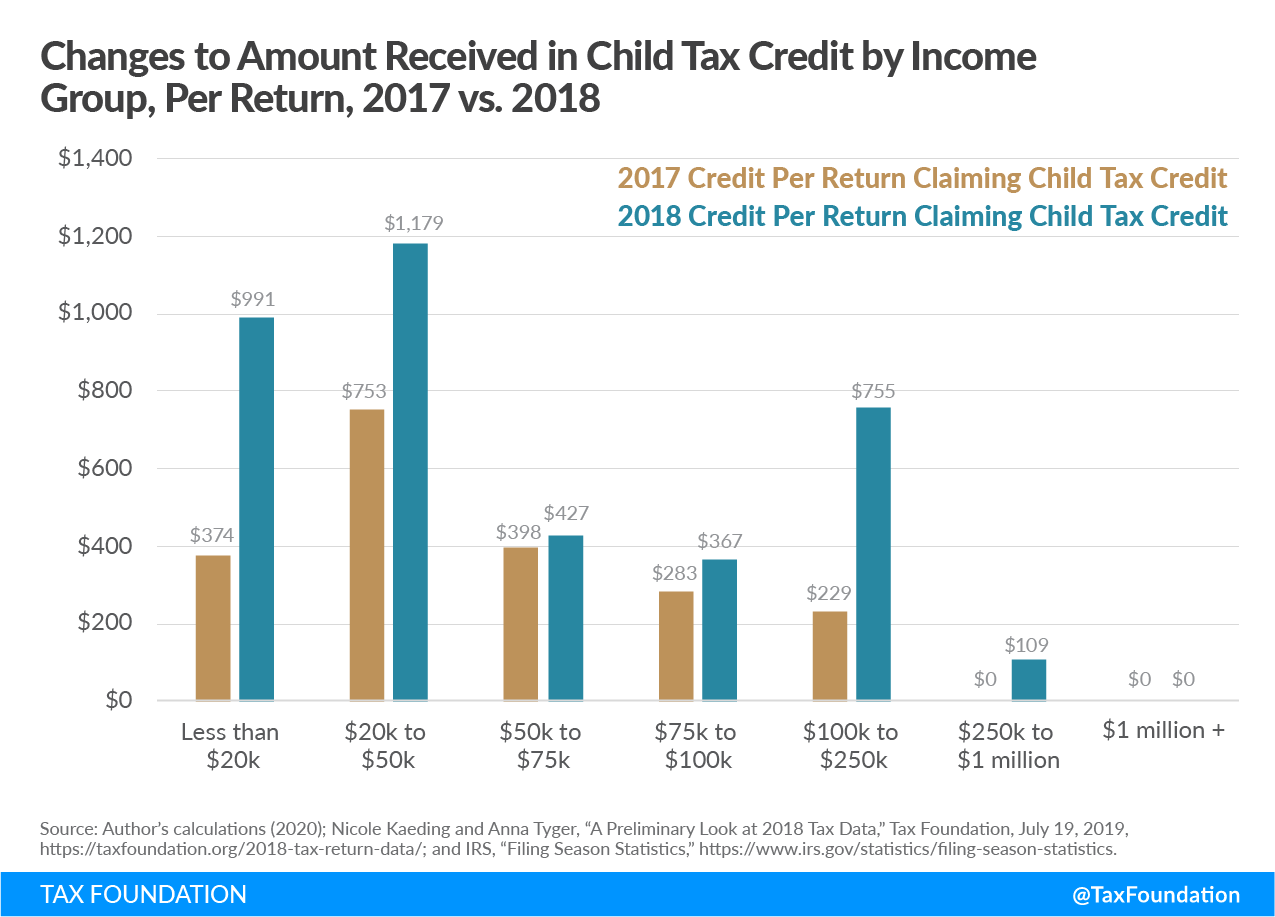

Web Ontario Child Care Tax Credit rate calculation. The dependent care tax credit is different than the child tax credit and. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a.

Dates for earlier payments are shown. The Instructions for Form 2441. Web IRS Tax Tip 2022-33 March 2 2022.

Canceled checks or money orders.

The Child Care Credit And Your Us Expat Tax Return When Abroad

Child Care Tax Savings 2021 Curious And Calculated

The Child Tax Credit Research Analysis Learn More About The Ctc

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

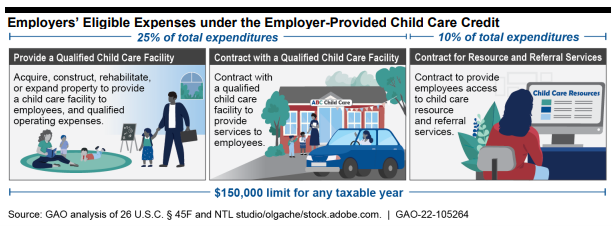

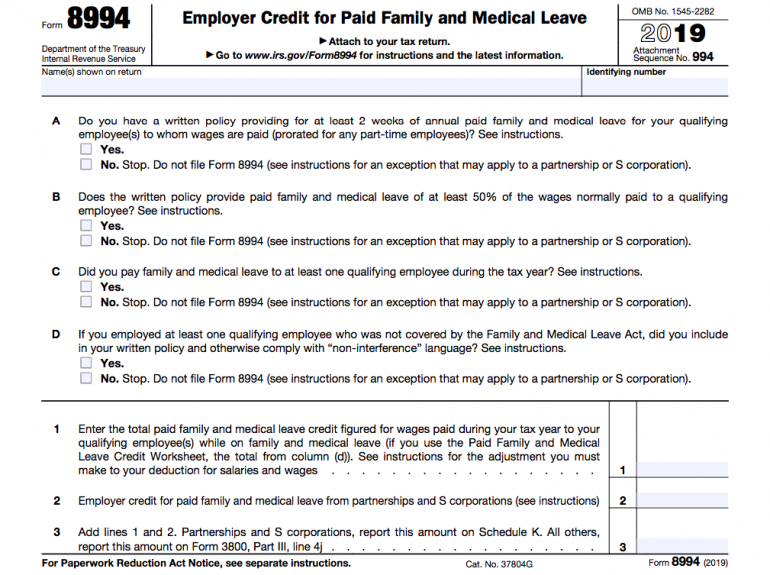

Small Business Tax Credits The Complete Guide Nerdwallet

Family Provisions In The New Tax Code Tax Foundation

Some D C Lawmakers Are Asking If Every Family Should Get A Child Care Tax Credit Wamu

Child Dependent Care Tax Credit Atlanta Support Lawyer Smyrna Georgia Divorce Attorney Meriwether Tharp Llc

What Is The Child Tax Credit Tax Policy Center

Child And Dependent Care Expenses Tax Credit Tl Dr Accounting

New Child Care Tax Credit Program In Pennsylvania

What Families Need To Know About The Ctc In 2022 Clasp

The Child Care Tax Credit Is A Good Claim On 2020 Taxes Even Better For 2021 Returns Don T Mess With Taxes

Current Child Care Tax Credit Download Table

How The New Expanded Federal Child Tax Credit Will Work Missouri Independent